Free Paycheck Calculator: Hourly & Salary Take Home After Taxes

Table of Content

If you know your tax code, enter it into the tax code box for a more accurate take-home pay calculation. If you are unsure of your tax code just leave it blank and the default code will be applied. If your main residence is in Scotland, tick the "Resident in Scotland" box.

The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven't had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money. Some employers may quote you a "package" salary which includes their contribution to your KiwiSaver. This reduces your gross pay to compensate their obligation to contribute to KiwiSaver.

How Much Tax You'd Pay By Income Amount

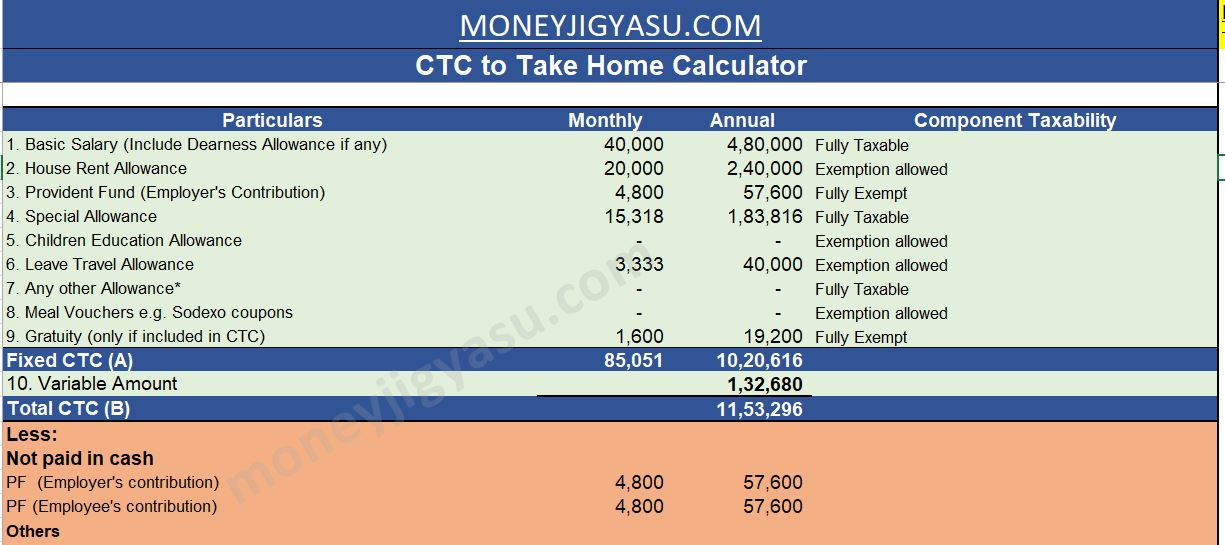

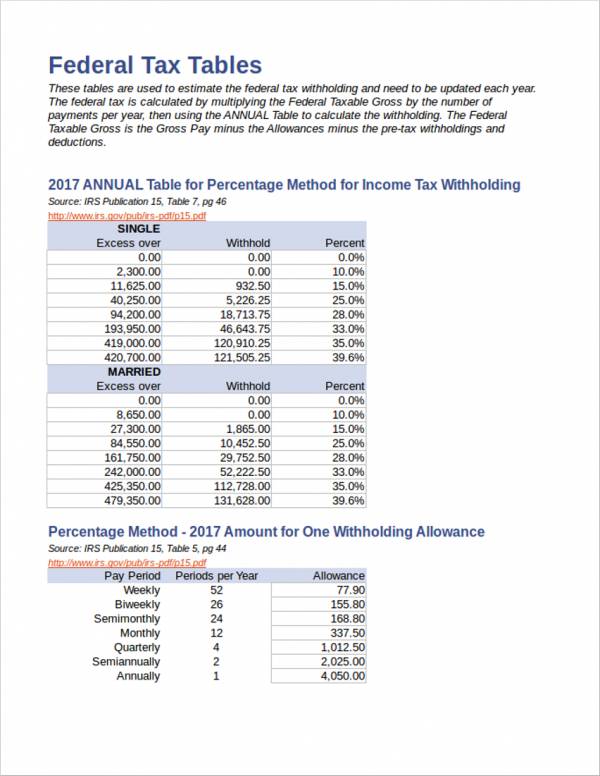

Your salary also determines how much you pay out in federal taxes. This calculator estimates the average tax rate as the federal income tax liability divided by the total gross income. Some calculators may use taxable income when calculating the average tax rate.

If you're an employee, your taxes are calculated and paid in real-time through the Pay As You Earn system, which automatically deducts taxes from your paychecks. If you're self-employed or starting a business, you must use the pay and file system to self-assess. You should also anticipate contributions to Pay Related Social Insurance and the Universal Social Charge . The size of your paycheck is also affected by your pay frequency. If you get paid biweekly, your checks will be smaller than if you get paid monthly.

Gross Income

Tick the "Married" box to apply this rebate to calculations - otherwise leave the box clear. Those who are registered blind are entitled to an increased personal allowance which reduces the amount of tax you pay. You might agree with your employer to contractually reduce your salary by a certain amount, in exchange for some non-cash benefits. From April 2017, most schemes will only save National Insurance on the value of those benefits. There are now three repayment methods for Student Loans, which are known as Plan 1, Plan 2 and Postgraduate Loans.

The calculation is based on the 2022 tax brackets and the new W-4, which, in 2020, has had its first major change since 1987. For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your company’s health plan, you can see the amount that is deducted from each paycheck.

Federal Paycheck Calculator

Reading them is simply a matter of making sure the payment information is correct. Learn more about Privacy at ADP, including understanding the steps that we’ve taken to protect personal data globally. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. Unfortunately, we are currently unable to find savings account that fit your criteria. Your tax code is displayed when calculating your take home pay. The starting-out and training minimum wage is 80% of the adult minimum wage or .

The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. How much you pay in federal income taxes depends on several factors, including your marital status and if you want additional tax withheld from your paycheck. Your employer withholds taxes based on what you indicated about these factors on your W-4 form. You have to fill out a new W-4 every time to start new employment or if you want to make any changes.

What would happen to your take-home pay if you were to have a second job? These calculations do not take into account any tax rebates or tax offsets you may be entitled to. This calculator can also be used as an Australian tax return calculator. Note that it does not take into account any tax rebates or tax offsets you may be entitled to. According to 2021 figures, the average salary in Canada is $59,104, a far cry from the 2020 median salary displayed in the table below. For a detailed breakdown of the Canadian tax system, an estimate of your taxes due, and a better idea of your net income, visit our Canadian Tax Calculator.

Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future. Your employer determines how much to withhold from your paychecks using the information you indicate on your Form W-4. You have to fill out a new form every time you start a job or if you want to make changes to your withholding at any time. You should look to change your withholding information whenever you experience big life changes, such as getting married or having a child. Nevada is one of a handful of states that does not have a state income tax.

Employers withhold federal income tax from their workers’ pay based on current tax rates and Form W-4, Employee Withholding Certificates. Trying to work out what that annual gross salary actually means? Let The Take-Home Calculator tell you what it's worth on a monthly, weekly or daily basis - our tax calculator also considers NI, student loan and pension contributions. When you're done, click on the "Calculate!" button, and the table on the right will display the information you requested from the tax calculator. You'll be able to see the gross salary, taxable amount, tax, national insurance and student loan repayments on annual, monthly, weekly and daily bases.

Nevada may not charge any state income taxes, but residents still have to pay federal income taxes and FICA taxes. Your Nevada employer will withhold federal income taxes from each of your paychecks and send that money to the IRS, which counts it toward your annual income taxes. You can also elect to have additional withholdings taken out of your paycheck. If you are enrolled in an employer-provided health insurance plan, any premiums you pay will come from your salary. Similarly if you choose to invest in a 401 or 403 retirement plan, your contributions are deducted from your pay. These contributions are also pre-tax, which means they come out of your pay before taxes are applied.

Komentar

Posting Komentar